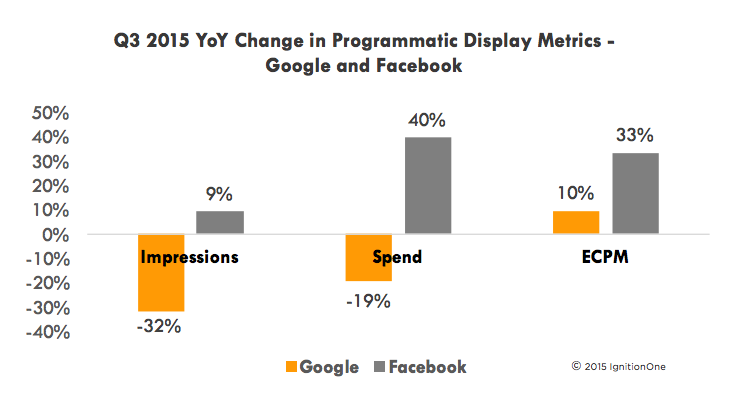

Facebook FB +0.82% continues picking up on Google display ads growth GOOGL +0.75% in the business of selling display advertisements that bolster a large number of websites and applications.

Recent survey reveals that Facebook saw 40% growth during the last three months in display ads conveyed via automated technology known as “programmatic”. Following an alternate metric from its set of advertisers back in July, Adobe found that in the second quarter, the rate of clicks on Facebook advertisements nearly doubled from the prior year, while Google click rates climbed just 24%. That may have been a sway’s symptom of changes Google made in April to its search rankings of sites taking into account whether they look great on mobile devices.

In the interim, Google, which conveys show promotions on YouTube, in addition to its advertisement syndication system of exactly 2 million sites, saw a drop of 19%, as per the most recent quarterly review from advanced advertising management firm IgnitionOne.

“This time, there are at least two other possibilities for Google’s display underperformance versus Facebook”, says IgnitionOne CEO Will Margiloff. To begin with, it’s clear that Facebook’s capacity to recognize individuals on the grounds that they’re signed in means it can store up a considerable measure of very exact information on their conduct and inclinations so promoters can better target important advertisements to them–not just on Facebook yet on numerous different sites where Facebook syndicates its promotions.

“But the surge in display ad spending on Facebook also may stem partly from the success of Google’s search ads”, says Margiloff. The amount of income Google gets from every snap on an inquiry promotion rose 21% in the third quarter. That is much higher than 15% “cost per click” growth in the second quarter and 10% in the first quarter–and far higher than the 3% or less growth for the most part of 2014.

That is incredible for Google similarly as it goes, on the grounds that versatile commercial costs have quite slacked costs of promotions as viewed on computers. Yet, few advertisers may discover the cost increases so steep that they’re beginning to search somewhere else for less expensive promotion purchases. “Marketers may have found some interesting nooks and crannies to reach customers through display ads on Facebook instead,” says Margiloff.

Google’s search business isn’t yet hurting, and inquiry promotion incomes climbed 12% from the prior year, much speedier than showcase advertisement’s 7% rise. So Margiloff says the impact is little at best–but beyond any doubt to develop if search ad costs continue rising. Google still has 27% of the business sector, yet that is down from 35% a year back. Then, Facebook’s offer has shot up from 10% to 16%. Generally speaking, the business sector is up 7% from 2014.

Despite appearances from this quarterly report, Google’s display business isn’t generally tumbling off a bluff. In particular, YouTube is seen as progressively alluring to brand advertisers searching past TV for younger audiences. In addition, Google display ads added some new weapons to its display arsenal that match Facebook’s, such as the ability of the promoters to match clients by their emails to their signed in Google accounts, to target similar interests on YouTube and Gmail.

“You’re going to see a lot of tit-for-tat with these two companies,” Margiloff says. The two organizations continue to compete on grabbing a larger share of the overall online advertising pie which generally is anticipated in the next years to come.